The outbreak of coronavirus disease has put an additional stress on the Russian economy. It was already coping with a slump in oil prices.

Russia has ample reserves to weather the storm, but average Russians could feel the pain.

Rainy day

After the West imposed sanctions in 2014, the ruble experienced a sharp devaluation. To avoid a repeat, Russia built up its foreign exchange reserves. At $550 billion — including a $150 national wealth fund — they are now the fourth largest in the world.

The goal of this policy was to avoid further currency depreciations and save money for a rainy day.

But when Saudi Arabia initiated an oil price war in March, in an attempt to convince Russia to cut production, the ruble again lost value against the dollar. It now trades at its lowest rate since 2016. The price of a barrel of oil has fallen from $70 to $27.

Before the dispute, Russia’s budget was projected to post a surplus. It is now in deficit.

Russia can tap its reserves to prop up the ruble or mend the shortfall, but that would leave less money for social spending.

A weak ruble also undermines the purchasing power of Russian citizens, who have seen their disposable incomes fall for years.

The coronavirus makes all these problems worse.

Coronavirus

1,036 cases of coronavirus disease have been reported in Russia so far, far fewer than in Western European countries.

Russia handled the early days of the pandemic with extreme care. It closed its border with China, where the pandemic originated, in January. In February, it started testing travelers from virus hotspots for the disease.

Response

The devaluation of the ruble and consumer stockpiling of produce could raise inflation in the short term. On the other hand, slowing growth and weak domestic and external demand have the opposite effect. Thus the central bank isn’t changing its interest rate yet.

The city of Moscow is allowing small and medium-sized businesses to delay paying rent on municipal and state properties for six months.

National measures include:

- Delaying loan payments for small and medium-sized business by six months.

- Extending all social benefits automatically (no documentation required).

- Freezing private loans and mortgages for those who have lost at least 30 percent of their incomes.

- Raising unemployment benefits to match the minimum wage.

Years of fiscal restraint allow Russia to raise spending now. But underspending in previous years has come at a cost, including in health care. There is fear that the pandemic will expose equipment shortages.

The new measures will be funded in part by a 13 percent tax on interest earned on deposits of 1 million rubles and more as well as a 15 percent tax on dividend income that is paid into overseas accounts, leaving the national wealth fund untapped. But if cases continue to rise, and more people lose their jobs, the government could be forced to dig into the rainy-day fund after all.

Political effects

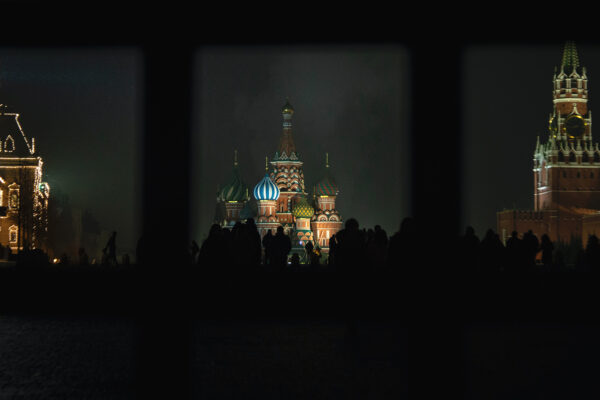

President Vladimir Putin has postponed a referendum on extending his rule by twelve years. His political future now depends on steering Russia through this crisis.

If he succeeds, it will reinforce his image as Russia’s savior. But if the virus intensifies, the government will either have to implement new taxes or tap into its reserves.

Either would imply a social cost, which will be paid later.