President Joe Biden would make the same mistake as the Netherlands in regulating independent work.

In 2015, the European country required employers to put freelancers on an open-ended contract after two years of work.

In an attempt to bring more workers into regular employment, a coalition government of the center-left Labor Party and center-right liberals also made it costlier and more time-consuming for companies to fire employees, and it increased severance pay.

The reforms didn’t cause a shift from freelancing to salaried employment. They did destroy some 77,000 — mostly part-time — jobs in child care, hospitality, nursing and other industries, according to an analysis by ABN Amro bank.

After Labor lost the election in 2017, the liberals formed a government with center parties and repealed the reforms. They made it cheaper for companies to hire, and easier to fire, employees. Freelancers were allowed three contracts per employer every three years.

Employment rose. There are more Dutch people in work than ever before. Almost every industry, from construction to schools to the national railway, struggles to fill vacancies.

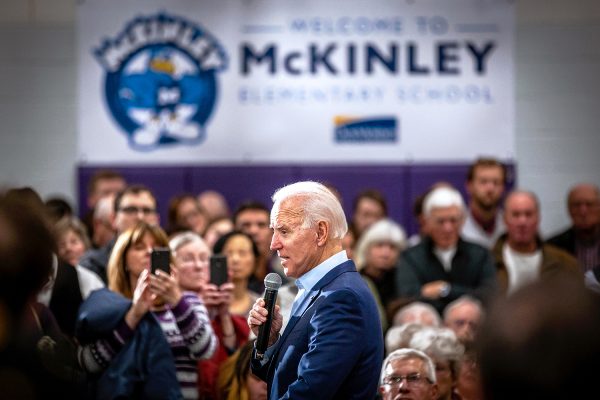

Biden goes the other way

Biden’s Labor Department would repeat the Dutch Labor Party’s mistake by narrowing the definition of a contractor.

The Wall Street Journal warns:

Newspaper columnists, truck drivers, real estate agents, barbers, consultants and many other freelancers could be ensnared.

Who is an employee?

Proposed rules classify workers as employees when they are “economically dependent” on their employer.

Economic dependence would be determined by:

- The worker’s opportunity for profit or loss depending on their ability to accept or decline jobs.

- The control a worker has over price-setting, scheduling, supervision and other “economic aspects” of the work relationship.

That would mean an Uber driver, who is punished by the company’s algorithm when he declines a ride and can’t negotiate the price he’s paid, would be considered an employee.

- The permanence of the work relationship. An open-ended contract suggests employee status.

- “Entrepreneurial” investments, in a worker’s ability to do additional work, indicate contractor status. “Capital” investments, in tools to perform a specific job, indicate employee status.

This gets trickier, but now the hard part:

- The extent to which the work is “integral” to the employer’s business.

The assumption is that “integral” work should be done by employees. But what if the work is integral but temporary, like a renovation or a systems upgrade? What if self-employment is the norm in an industry? In both America and the Netherlands, many surgeons contract for hospitals, where their work is clearly integral. Few want to become employees. If they are forced to, surgeons might find it harder to work in multiple hospitals. Patients would have to travel farther for surgeries.

- Whether the workers’ skills are “specialized”, to perform certain tasks, or “managerial”, affecting success or failure.

Good luck to the bureaucrats who will have to figure that out.

Many prefer freelancing

The difference between contractor and employee status matters more in America than in Europe. In the Netherlands, freelancers don’t qualify for overtime and unemployment insurance either. But in the United States, they’re not even covered by minimum wage and they don’t have the right to unionize.

Yet millions of workers prefer it.

Scott Lincicome of the libertarian Cato Institute argues in The Dispatch that policymakers seem to believe all freelancers are underpaid “gig economy” couriers and warehouse workers. They’re not.

MBO Partners, which provides contracting services, estimates that 51 million Americans are self-employed: 31 percent of the labor force. (It also found that two in three feel financially secure.) Freelancing platform Upwork puts the share at 36 percent.

1.1 million Dutch workers are self-employed, or 12 percent of the labor force. When you include on-call workers and employees with temporary or fixed-term contracts, the share rises to 40 percent. That hasn’t changed in the last ten years. There has been a shift from temp work to freelancing.

Most freelancers are high-paid

Most freelancers in both countries work in high-paid professions, like consulting, health care, marketing and tech.

In 2019, under 9 percent of freelancers in the United States worked in the “gig economy”. Even they were usually content: a 2021 Pew Research poll found that 78 percent were at least “somewhat” satisfied with their work, higher pay and flexibility being the main reasons. A 2015 survey by the Government Accountability Office found that 85 percent of all freelancers are happy with their situation.

Some can’t work 9 to 5. 46 percent of freelancers in America have family commitments or medical issues that prevent them from working a full-time job.

Should the vast majority of freelancers, who are happy with their work and who might not have an alternative, be punished because a tiny share is exploited?

Noah Rothman thinks not. The right-wing commentator writes for MSNBC that, “on balance, the losers [of Biden’s rules] will far outnumber its winners.”

Why companies prefer contractors

For those freelancers who would prefer a salaried job, it’s worth asking why employers don’t just give them one?

In the Netherlands, the small business association has told the government for years the main reason is sick leave. Unique among developed countries, employees in the Netherlands are entitled to two years of sick leave with 70 percent of their salary. It used to be one year.

Employers also pay the full cost of unemployment insurance. Workers used to contribute to the fund, which entitles them to two years of benefits if they’re fired.

Firing employees can be costly: severance can reach a full year’s salary with a maximum of €84,000 per employee, more than twice the median wage.

In the United States, the main reason is health insurance, which employees get from their employer, but which contractors must buy themselves. Employees are about 20 percent more expensive than freelancers.

(Employer-sponsored health insurance is also one of the reasons American health care compares so poorly to other wealthy nations: consumers don’t have much choice, which means insurers don’t really compete. It stifles labor mobility.)

What should be done

There ought to be minimum protections for all workers:

- Minimum wage should apply to everyone.

- Everyone should have the right to organize. Businessowners organize in trade associations. Employees organize in trade unions. Why should contractors be exempt? (There are two unions of self-employed workers in the Netherlands. The largest Dutch trade union, to their credit, provides services to freelancers too.)

That should fix some of the problems at the bottom of the labor market, not just for faux contractors.

Beyond that, I think the control element of Biden’s “economic dependence” test is fair. If your employer decides which hours you must work, the way you work, and there’s no option to bargain about compensation, you’re not an independent contractor.

The permanence and investment elements are debatable. Think of our freelancing surgeon: she may have an open-ended contract and the hospital invests in tools to help her do her work, but what is the problem we’re trying to solve? She’s going to be fine financially either way, but contracting has non-financial benefits to her (and her clients), as it does for most freelancers.

If governments insist they have too many freelancers, they might consider deregulating salaried work before overregulating contracting. Dutch employers shouldn’t carry all the financial risks of illness and unemployment. America should get rid of employer-sponsored health insurance and switch to Obamacare-for-all.